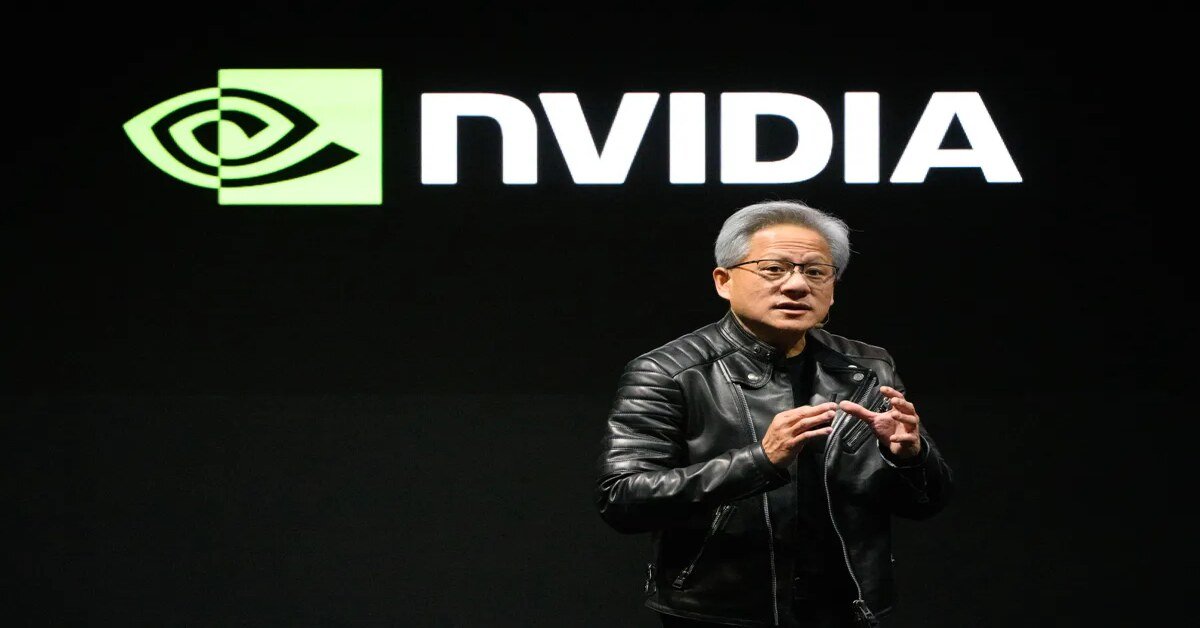

Nvidia, the global leader in high-performance GPUs, has rapidly evolved from a hardware powerhouse into a strategic investor shaping the future of artificial intelligence. With a market cap soaring to $4.5 trillion in 2025, Nvidia’s aggressive investment strategy in AI startups is not just about expanding its portfolio — it’s about building an AI empire. This blog explores Nvidia’s top startup investments, revealing how the company is fueling innovation across the AI ecosystem.

Nvidia’s AI Investment Surge: A Strategic Shift

Since the launch of ChatGPT and the explosion of generative AI platforms, Nvidia has seen unprecedented growth in revenue, profitability, and cash reserves. Leveraging this momentum, the company has dramatically increased its venture capital activity. In 2025 alone, Nvidia participated in over 50 startup deals — surpassing its total for all of 2024. Notably, these figures exclude investments made through NVentures, Nvidia’s corporate VC arm, which also ramped up its pace with 21 deals this year compared to just one in 2022. Nvidia’s stated goal is clear: to back “game changers and market makers” that expand the AI ecosystem.

Billion-Dollar Bets: Nvidia’s Biggest AI Investments

Nvidia’s investment strategy centers on high-impact startups with transformative potential. Here are some of the most significant deals:

- OpenAI: Nvidia joined OpenAI’s $6.6 billion round in October 2024 with a $100 million investment. The company later announced plans to invest up to $100 billion in OpenAI through a strategic partnership.

- xAI: Despite OpenAI’s push to limit rival funding, Nvidia backed Elon Musk’s xAI with $6 billion and committed up to $2 billion more for future infrastructure purchases.

- Reflection AI: Nvidia led a $2 billion round for this U.S.-based competitor to DeepSeek, aiming to offer open-source alternatives to closed AI models.

- Thinking Machines Lab: Founded by former OpenAI CTO Mira Murati, this startup raised $2 billion in seed funding with Nvidia among the backers.

- Figure AI: Nvidia invested in this humanoid robotics company’s $1 billion Series C round, valuing it at $39 billion.

These investments reflect Nvidia’s commitment to not just supplying GPUs but actively shaping the future of AI development.

Diversified Portfolio: From Data Centers to Autonomous Driving

Beyond generative AI, Nvidia is investing in a wide range of sectors:

- Nscale: Building data centers in the UK and Norway for OpenAI’s Stargate project, Nvidia participated in both equity and SAFE funding rounds totaling over $1.5 billion.

- Wayve: A self-learning autonomous driving startup, Wayve received $1.05 billion from Nvidia and expects an additional $500 million investment.

- Scale AI: Nvidia joined Amazon and Meta in a $1 billion round for this data-labeling company, which is critical for training AI models.

- Commonwealth Fusion: Nvidia’s $863 million investment in this nuclear fusion startup signals interest in energy solutions for AI infrastructure.

- Perplexity: Nvidia has consistently backed this AI search engine across multiple rounds, helping it reach a $20 billion valuation

📈 Why Nvidia’s Investment Strategy Matters

Nvidia’s approach is reshaping the AI landscape in several ways:

- Infrastructure Expansion: By funding data centers and cloud providers, Nvidia ensures its GPUs remain central to AI development.

- Ecosystem Building: Strategic investments in startups like Cohere, Waabi, and Lambda help create a robust AI ecosystem.

- Global Reach: Nvidia’s portfolio spans continents, with investments in Europe (Mistral AI), Asia (Sakana AI, Firmus Technologies), and North America.

Final Thoughts: The Future of AI Powered by Nvidia

Nvidia’s aggressive investment strategy is more than financial — it’s visionary. By backing startups across AI infrastructure, generative models, robotics, and autonomous systems, Nvidia is positioning itself as the backbone of the AI revolution.

As the demand for AI-powered solutions grows, Nvidia’s role as both a supplier and strategic investor will continue to shape the industry. For entrepreneurs, developers, and investors, understanding Nvidia’s AI investment strategy offers valuable insights into where the future is headed.