Vitalik Buterin through the Vitalik Buterin Weblog

Up to date 2018-07-28. See finish be aware.

The next is an attention-grabbing concept that I had two years in the past that I personally imagine has promise and may very well be simply applied within the context of a blockchain ecosystem, although if desired it might actually even be applied with extra conventional applied sciences (blockchains would assist get the scheme community results by placing the core logic on a extra impartial platform).

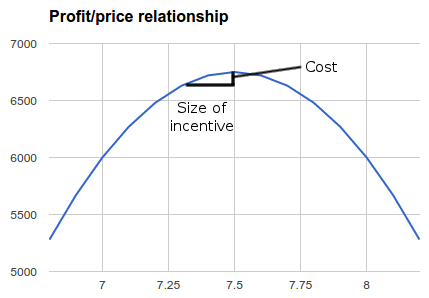

Suppose that you’re a restaurant promoting sandwiches, and also you ordinarily promote sandwiches for $7.50. Why did you select to promote them for $7.50, and never $7.75 or $7.25? It clearly can’t be the case that the price of manufacturing is strictly $7.49999, as in that case you’ll be making no revenue, and wouldn’t be capable to cowl mounted prices; therefore, in most conventional conditions you’ll nonetheless be capable to make some revenue for those who offered at $7.25 or $7.75, although much less. Why much less at $7.25? As a result of the value is decrease. Why much less at $7.75? Since you get fewer clients. It simply so occurs that $7.50 is the purpose at which the stability between these two components is perfect for you.

Now, you can argue that shops are usually not completely rational, and never completely knowledgeable, and they also might not truly be charging at optimum costs, all components thought-about. Nevertheless, for those who don’t know what course the deviation is in for any given retailer, then even nonetheless, in expectation, the scheme works the identical method - besides as a substitute of shedding $17 it’s extra like flipping a coin the place half the time you acquire $50 and half the time you lose $84. Moreover, within the extra complicated scheme that we’ll describe later, we’ll be adjusting costs in each instructions concurrently, and so there is not going to even be any further danger – irrespective of how appropriate or incorrect the unique worth was, the scheme offers you a predictable small internet loss.

Additionally, the above instance was one the place marginal prices are excessive, and clients are choosy about costs - within the above mannequin, charging $9 would have netted you no clients in any respect. In a state of affairs the place marginal prices are a lot decrease, and clients are much less price-sensitive, the losses from elevating or decreasing costs could be even decrease.

So what’s the level of all this? Nicely, suppose that our sandwich store adjustments its coverage: it sells sandwiches for $7.55 to most people, however lowers the costs to $7.35 for individuals who volunteered in some charity that maintains some native park (say, that is 25% of the inhabitants). The shop’s new revenue is $6682.5⋅0.25+$6742.5⋅0.75=$6727.5 (that’s a $22.5 loss), however the result’s that you’re now paying all 4500 of your clients 20 cents every to volunteer at that charity - an incentive dimension of $900 (for those who simply depend the purchasers who truly do volunteer, $225). So the shop loses a bit, however will get an enormous quantity of leverage, de-facto contributing at the least $225 relying on the way you measure it for a value of solely $22.5.

Now, what we will begin to do is construct up an ecosystem of “stickers”, that are non-transferable digital “tokens” that organizations hand out to individuals who they suppose are contributing to worthy causes. Tokens may very well be organized by class (eg. poverty reduction, science analysis, environmental, area people initiatives, open supply software program growth, writing good blogs), and retailers could be free to cost marginally decrease costs to holders of the tokens that symbolize no matter causes they personally approve of.

The subsequent stage is to make the scheme recursive – being or working for a service provider that provides decrease costs to holders of inexperienced stickers is itself sufficient to advantage you a inexperienced sticker, albeit one that’s of decrease efficiency and provides you a decrease low cost. This fashion, if a whole group approves of a specific trigger, it might truly be profit-maximizing to begin providing reductions for the related sticker, and so financial and social stress will preserve a sure degree of spending and participation towards the trigger in a secure equilibrium.

So far as implementation goes, this requires:

- A regular for stickers, together with wallets the place folks can maintain stickers

- Cost programs which have assist for charging decrease costs to sticker holders included

- A minimum of a number of sticker-issuing organizations (the bottom overhead is more likely to be issuing stickers for charity donations, and for simply verifiable on-line content material, eg. open supply software program and blogs)

So that is one thing that may actually be bootstrapped inside a small group and person base after which let to develop over time.

Replace 2017.03.14: right here is an financial mannequin/simulation exhibiting the above applied as a Python script.

Replace 2018.07.28: after discussions with others (Glen Weyl and a number of other Reddit commenters), I noticed a number of further issues about this mechanism, some encouraging and a few worrying:

- The above mechanism may very well be used not simply by charities, but additionally by centralized company actors. For instance, a big company might supply a bribe of $40 to any retailer that provides the 20-cent low cost to clients of its merchandise, gaining further income a lot greater than $40. So it’s empowering however probably harmful within the mistaken palms… (I’ve not researched it however I’m certain this type of approach is utilized in numerous sorts of loyalty applications already)

- The above mechanism has the property {that a} service provider can “donate” $� to charity at a value of $�2 (be aware: �2<� on the scales we’re speaking about right here). This offers it a construction that’s economically optimum in sure methods (see quadratic voting), as a service provider that feels twice as strongly about some public good have a propensity to supply twice as massive a subsidy, whereas most different social selection mechanisms are inclined to both undervalue (as in conventional voting) or overvalue (as in shopping for insurance policies through lobbying) stronger vs weaker preferences.

- website positioning Powered Content material & PR Distribution. Get Amplified As we speak.

- PlatoData.Community Vertical Generative Ai. Empower Your self. Entry Right here.

- PlatoAiStream. Web3 Intelligence. Data Amplified. Entry Right here.

- PlatoESG. Carbon, CleanTech, Power, Surroundings, Photo voltaic, Waste Administration. Entry Right here.

- PlatoHealth. Biotech and Scientific Trials Intelligence. Entry Right here.

- BlockOffsets. Modernizing Environmental Offset Possession. Entry Right here.

- Supply: Plato Knowledge Intelligence.