Notice: I point out the names of varied initiatives beneath solely to match and distinction their token sale mechanisms; this could NOT be taken as an endorsement or criticism of any particular venture as a complete. It’s completely attainable for any given venture to be whole trash as a complete and but nonetheless have an superior token sale mannequin.

The previous few months have seen an growing quantity of innovation in token sale fashions. Two years in the past, the house was easy: there have been capped gross sales, which offered a hard and fast variety of tokens at a hard and fast worth and therefore mounted valuation and would usually shortly promote out, and there have been uncapped gross sales, which offered as many tokens as individuals had been prepared to purchase. Now, now we have been seeing a surge of curiosity, each when it comes to theoretical investigation and in lots of circumstances real-world implementation, of hybrid capped gross sales, reverse dutch auctions, Vickrey auctions, proportional refunds, and lots of different mechanisms.

Many of those mechanisms have arisen as responses to perceived failures in earlier designs. Practically each vital sale, together with Courageous’s Primary Consideration Tokens, Gnosis, upcoming gross sales resembling Bancor, and older ones resembling Maidsafe and even the Ethereum sale itself, has been met with a considerable quantity of criticism, all of which factors to a easy truth: thus far, now we have nonetheless not but found a mechanism that has all, and even most, of the properties that we wish.

Allow us to overview just a few examples.

Maidsafe

The decentralized web platform raised $7m in 5 hours. Nonetheless, they made the error of accepting cost in two currencies (BTC and MSC), and giving a positive price to MSC consumers. This led to a short lived ~2x appreciation within the MSC worth, as customers rushed in to purchase MSC to take part within the sale on the extra favorable price, however then the worth noticed a equally steep drop after the sale ended. Many customers transformed their BTC to MSC to take part within the sale, however then the sale closed too shortly for them, resulting in them being caught with a ~30% loss.

This sale, and several other others after it (cough cough WeTrust, TokenCard), confirmed a lesson that ought to hopefully by now be uncontroversial: working a sale that accepts a number of currencies at a hard and fast change price is harmful and unhealthy. Don’t do it.

Ethereum

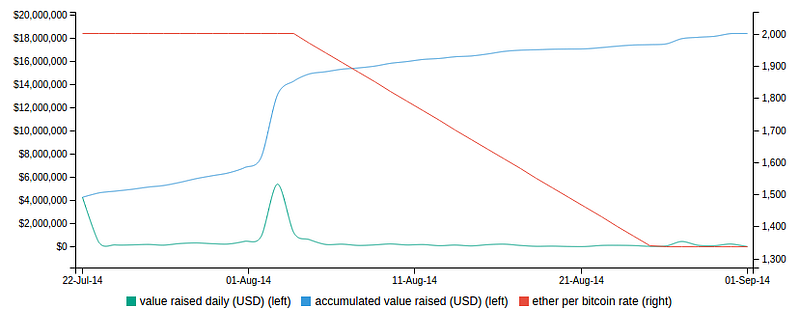

The Ethereum sale was uncapped, and ran for 42 days. The sale worth was 2000 ETH for 1 BTC for the primary 14 days, after which began growing linearly, ending at 1337 ETH for 1 BTC.

Within the Ethereum sale, consumers who actually cared about predictability of valuation typically purchased on the 14th day, reasoning that this was the final day of the complete low cost interval and so forth at the present time that they had most predictability along with the complete low cost, however the sample above is hardly economically optimum habits; the equilibrium could be one thing like everybody shopping for in on the final hour of the 14th day, making a personal tradeoff between certainty of valuation and taking the 1.5% hit (or, if certainty was actually necessary, purchases may spill over into the fifteenth, sixteenth and later days). Therefore, the mannequin actually has some quite bizarre financial properties that we would like to keep away from if there’s a handy approach to take action.

BAT

All through 2016 and early 2017, the capped sale design was hottest. Capped gross sales have the property that it is rather seemingly that curiosity is oversubscribed, and so there’s a giant incentive to getting in first. Initially, gross sales took just a few hours to complete. Nonetheless, quickly the pace started to speed up. First Blood made plenty of information by ending their $5.5m sale in two minutes – whereas lively denial-of-service assaults on the Ethereum blockchain had been going down. Nonetheless, the apotheosis of this race-to-the-Nash-equilibrium didn’t come till the BAT sale final month, when a $35m sale was accomplished inside 30 seconds as a result of great amount of curiosity within the venture.

- The entire transaction charges paid had been 70.15 ETH (>$15,000), with the best single price being ~$6,600

- 185 purchases had been profitable, and over 10,000 failed

- The Ethereum blockchain’s capability was full for 3 hours after the sale began

Thus, we’re beginning to see capped gross sales strategy their pure equilibrium: individuals attempting to outbid one another’s transaction charges, to the purpose the place probably tens of millions of {dollars} of surplus could be burned into the fingers of miners. And that’s earlier than the subsequent stage begins: giant mining swimming pools butting into the beginning of the road and simply shopping for up the entire tokens themselves earlier than anybody else can.

Gnosis

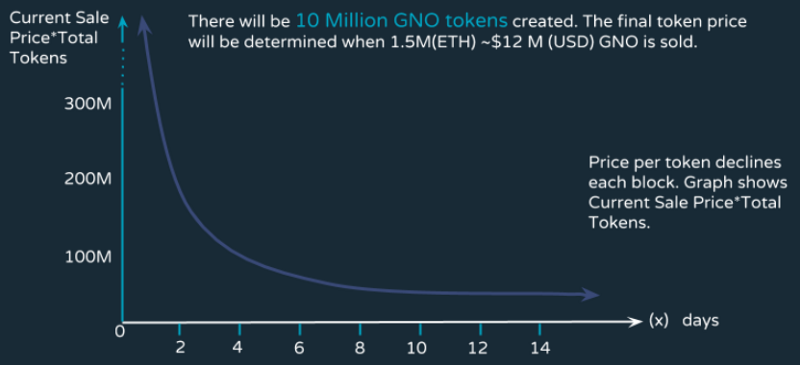

The Gnosis sale tried to alleviate these points with a novel mechanism: the reverse dutch public sale. The phrases, in simplified type, are as follows. There was a capped sale, with a cap of $12.5 million USD. Nonetheless, the portion of tokens that will truly be given to purchasers relied on how lengthy the sale took to complete. If it completed on the primary day, then solely ~5% of tokens could be distributed amongst purchasers, and the remaining held by the Gnosis group; if it completed on the second day, it might be ~10%, and so forth.

The aim of that is to create a scheme the place, for those who purchase at time �, then you’re assured to purchase in at a valuation which is at most 1�.

There are two attainable outcomes:

- The sale closes earlier than the valuation drops to beneath V. Then, you’re glad since you stayed out of what you thought is a nasty deal.

- The sale closes after the valuation drops to beneath V. Then, you despatched your transaction, and you’re glad since you obtained into what you thought is an effective deal.

Nonetheless, many individuals predicted that due to “concern of lacking out” (FOMO), many individuals would simply “irrationally” purchase in on the first day, with out even wanting on the valuation. And that is precisely what occurred: the sale completed in just a few hours, with the outcome that the sale reached its cap of $12.5 million when it was solely promoting about 5% of all tokens that will be in existence – an implied valuation of over $300 million.

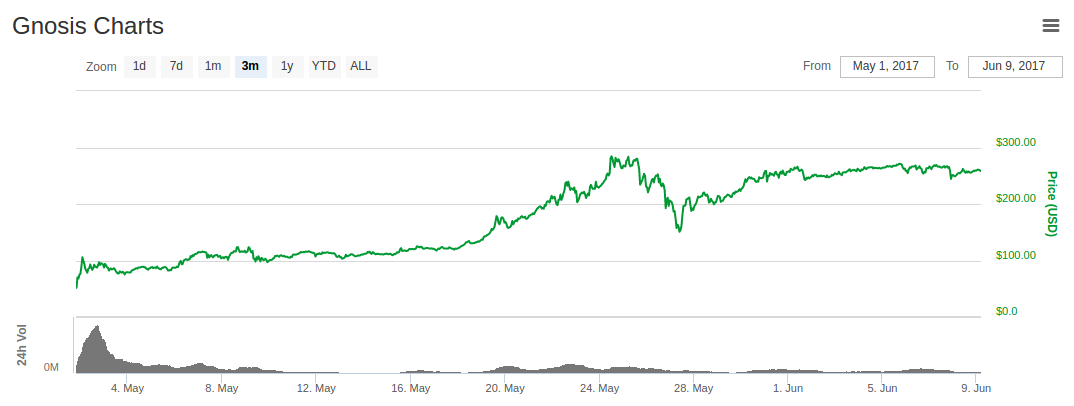

All of this may after all be a superb piece of confirming proof for the narrative that markets are completely irrational, individuals don’t suppose clearly earlier than throwing in giant portions of cash (and sometimes, as a subtext, that your entire house must be someway suppressed to stop additional exuberance) if it weren’t for one inconvenient truth: the merchants who purchased into the sale had been proper.

What occurred? A few weeks earlier than the sale began, dealing with public criticism that in the event that they find yourself holding nearly all of the cash they’d act like a central financial institution with the power to closely manipulate GNO costs, the Gnosis group agreed to carry 90% of the cash that weren’t offered for a 12 months. From a dealer’s standpoint, cash which can be locked up for a very long time are cash that can’t have an effect on the market, and so in a brief time period evaluation, would possibly as properly not exist. That is what initially propped up Steem to such a excessive valuation final 12 months in July, in addition to Zcash within the very early moments when the worth of every coin was over $1,000.

Now, one 12 months will not be that lengthy a time, and locking up cash for a 12 months is nowhere near the identical factor as locking them up eternally. Nonetheless, the reasoning goes additional. Even after the one 12 months holding interval expires, you’ll be able to argue that it’s within the Gnosis group’s curiosity to solely launch the locked cash in the event that they consider that doing so will make the worth go up, and so for those who belief the Gnosis group’s judgement this implies that they’re going to do one thing which is a minimum of nearly as good for the GNO worth as merely locking up the cash eternally. Therefore, in actuality, the GNO sale was actually far more like a capped sale with a cap of $12.5 million and a valuation of $37.5 million. And the merchants who participated within the sale reacted precisely as they need to have, leaving scores of web commentators questioning what simply occurred.

There may be actually a bizarre bubbliness about crypto-assets, with varied no-name belongings attaining market caps of $1-100 million (together with BitBean as of the time of this writing at $12m, PotCoin at $22m, PepeCash at $13m and SmileyCoin at $14.7m) simply because. Nonetheless, there’s a powerful case to be made that the individuals on the sale stage are in lots of circumstances doing nothing improper, a minimum of for themselves; quite, merchants who purchase in gross sales are merely (appropriately) predicting the existence of an ongoing bubble has been brewing for the reason that begin of 2015 (and arguably, for the reason that begin of 2010).

Extra importantly although, bubble habits apart, there may be one other reputable criticism of the Gnosis sale: regardless of their 1-year no-selling promise, finally they are going to have entry to the whole lot of their cash, they usually will to a restricted extent have the ability to act like a central financial institution with the power to closely manipulate GNO costs, and merchants must cope with the entire financial coverage uncertainty that that entails.

Specifying the issue

So what would a good token sale mechanism appear like? A method that we are able to begin off is by wanting by way of the criticisms of current sale fashions that now we have seen and arising with a listing of desired properties.

Let’s do this. Some pure properties embrace:

- Certainty of valuation – for those who take part in a sale, it is best to have certainty over a minimum of a ceiling on the valuation (or, in different phrases, a flooring on the share of all tokens you’re getting).

- Certainty of participation – for those who attempt to take part in a sale, it is best to have the ability to typically depend on succeeding.

- Capping the quantity raised – to keep away from being perceived as grasping (or probably to mitigate threat of regulatory consideration), the sale ought to have a restrict on the sum of money it’s gathering.

- No central banking – the token sale issuer shouldn’t be capable of find yourself with an unexpectedly very giant proportion of the tokens that will give them management over the market.

- Effectivity – the sale mustn’t result in substantial financial inefficiencies or deadweight losses.

Sounds affordable?

Effectively, right here’s the not-so-fun half.

- (1) and (2) can’t be absolutely happy concurrently.

- At the least with out resorting to very intelligent tips, (3), (4) and (5) can’t be happy concurrently.

These could be cited as “the primary token sale dilemma” and “the second token sale trilemma”.

The proof for the primary dilemma is simple: suppose you may have a sale the place you present customers with certainty of a $100 million valuation. Now, suppose that customers attempt to throw $101 million into the sale. At the least some will fail. The proof for the second trilemma is an easy supply-and-demand argument. For those who fulfill (4), then you’re promoting all, or some mounted giant proportion, of the tokens, and so the valuation you’re promoting at is proportional to the worth you’re promoting at. For those who fulfill (3), then you’re placing a cap on the worth. Nonetheless, this means the chance that the equilibrium worth on the amount you’re promoting exceeds the worth cap that you just set, and so that you get a scarcity, which inevitably results in both (i) the digital equal of standing in line for 4 hours at a very talked-about restaurant, or (ii) the digital equal of ticket scalping – each giant deadwight losses, contradicting (5).

The primary dilemma can’t be overcome; some valuation uncertainty or participation uncertainty is inescapable, although when the selection exists it appears higher to strive to decide on participation uncertainty quite than valuation uncertainty. The closest that we are able to come is compromising on full participation to assure partial participation. This may be accomplished with a proportional refund (eg. if $101 million purchase in at a $100 million valuation, then everybody will get a 1% refund). We will additionally consider this mechanism as being an uncapped sale the place a part of the cost comes within the type of locking up capital quite than spending it; from this viewpoint, nevertheless, it turns into clear that the requirement to lock up capital is an effectivity loss, and so such a mechanism fails to fulfill (5). If ether holdings usually are not well-distributed then it arguably harms equity by favoring rich stakeholders.

The second dilemma is troublesome to beat, and lots of makes an attempt to beat it might simply fail or backfire. For instance, the Bancor sale is contemplating limiting the transaction gasoline worth for purchases to 50 shannon (~12x the conventional gasprice). Nonetheless, this now signifies that the optimum technique for a purchaser is to arrange numerous accounts, and from every of these accounts ship a transaction that triggers a contract, which then makes an attempt to purchase in (the indirection is there to make it not possible for the customer to by accident purchase in additional than they needed, and to scale back capital necessities). The extra accounts a purchaser units up, the extra seemingly they’re to get in. Therefore, in equilibrium, this might result in much more clogging of the Ethereum blockchain than a BAT-style sale, the place a minimum of the $6600 charges had been spent on a single transaction and never a complete denial-of-service assault on the community. Moreover, any type of on-chain transaction spam contest severely harms equity, as a result of the price of taking part within the contest is fixed, whereas the reward is proportional to how a lot cash you may have, and so the outcome disproportionately favors rich stakeholders.

Shifting ahead

There are three extra intelligent issues that you are able to do. First, you are able to do a reverse dutch public sale identical to Gnosis, however with one change: as an alternative of holding the unsold tokens, put them towards some type of public good. Easy examples embrace: (i) airdrop (ie. redistributing to all ETH holders), (ii) donating to the Ethereum Basis, (iii) donating to Parity, Brainbot, Smartpool or different firms and people independently constructing infrastructure for the Ethereum house, or (iv) some mixture of all three, probably with the ratios someway being voted on by the token consumers.

Second, you’ll be able to hold the unsold tokens, however resolve the “central banking” downside by committing to a completely automated plan for the way they’d be spent. The reasoning right here is much like that for why many economists are serious about rules-based financial coverage: even when a centralized entity has a considerable amount of management over a robust useful resource, a lot of the political uncertainty that outcomes could be mitigated if the entity credibly commits to following a set of programmatic guidelines for the way they apply it. For instance, the unsold tokens could be put right into a market maker that’s tasked with preserving the tokens’ worth stability.

Third, you are able to do a capped sale, the place you restrict the quantity that may be purchased by every particular person. Doing this successfully requires a KYC course of, however the good factor is a KYC entity can do that as soon as, whitelisting customers’ addresses after they confirm that the handle represents a singular particular person, and this may then be reused for each token sale, alongside different functions that may profit from per-person sybil resistance like Akasha’s quadratic voting. There may be nonetheless deadweight loss (ie. inefficiency) right here, as a result of this can result in people with no private curiosity in tokens taking part in gross sales as a result of they know they are going to have the ability to shortly flip them available on the market for a revenue. Nonetheless, that is arguably not that unhealthy: it creates a type of crypto common primary earnings, and if behavioral economics assumptions just like the endowment impact are even barely true it’ll additionally succeed on the aim of guaranteeing extensively distributed possession.

Are single spherical gross sales even good?

Allow us to get again to the subject of “greed”. I might declare that not many individuals are, in precept, against the concept of growth groups which can be able to spending $500 million to create a extremely nice venture getting $500 million. Relatively, what persons are against is (i) the concept of utterly new and untested growth groups getting $50 million suddenly, and (ii) much more importantly, the time mismatch between builders’ rewards and token consumers’ pursuits. In a single-round sale, the builders have just one probability to get cash to construct the venture, and that’s close to the beginning of the event course of. There is no such thing as a suggestions mechanism the place groups are first given a small sum of money to show themselves, after which given entry to increasingly capital over time as they show themselves to be dependable and profitable. Throughout the sale, there may be comparatively little data to filter between good growth groups and unhealthy ones, and as soon as the sale is accomplished, the inducement to builders to maintain working is comparatively low in comparison with conventional firms. The “greed” isn’t about getting a lot of cash, it’s about getting a lot of cash with out working laborious to point out you’re able to spending it properly.

If we wish to strike on the coronary heart of this downside, how would we resolve it? I might say the reply is straightforward: begin transferring to mechanisms aside from single spherical gross sales.

I can provide a number of examples as inspiration:

- Angelshares – this venture ran a sale in 2014 the place it offered off a hard and fast proportion of all AGS day-after-day for a interval of a number of months. Throughout every day, individuals may contribute a limiteless quantity to the crowdsale, and the AGS allocation for that day could be break up amongst all contributors. Mainly, that is like having 100 “micro-rounds” of uncapped gross sales over the course of most of a 12 months; I might declare that the period of the gross sales may very well be stretched even additional.

- Mysterium, which held a little-noticed micro-sale six months earlier than the massive one.

- Bancor, which lately agreed to place all funds raised over a cap right into a market maker which is able to keep worth stability together with sustaining a worth flooring of 0.01 ETH. These funds can’t be faraway from the market maker for 2 years.

It appears laborious to see the connection between Bancor’s technique and fixing time mismatch incentives, however a component of an answer is there. To see why, contemplate two situations. As a primary case, suppose the sale raises $30 million, the cap is $10 million, however then after one 12 months everybody agrees that the venture is a flop. On this case, the worth would attempt to drop beneath 0.01 ETH, and the market maker would lose all of its cash attempting to keep up the worth flooring, and so the group would solely have $10 million to work with. As a second case, suppose the sale raises $30 million, the cap is $10 million, and after two years everyone seems to be pleased with the venture. On this case, the market maker won’t have been triggered, and the group would have entry to your entire $30 million.

A associated proposal is Vlad Zamfir’s “secure token sale mechanism“. The idea is a really broad one which may very well be parametrized in some ways, however one strategy to parametrize it’s to promote cash at a worth ceiling after which have a worth flooring barely beneath that ceiling, after which permit the 2 to diverge over time, releasing up capital for growth over time if the worth maintains itself.

Arguably, not one of the above three are enough; we wish gross sales which can be unfold out over a fair longer time frame, giving us far more time to see which growth groups are probably the most worthwhile earlier than giving them the majority of their capital. However nonetheless, this looks like the best route to discover in.

Popping out of the Dilemmas

From the above, it ought to hopefully be clear that whereas there isn’t a strategy to counteract the dilemma and trilemma head on, there are methods to chip away on the edges by considering outdoors the field and compromising on variables that aren’t obvious from a simplistic view of the issue. We will compromise on assure of participation barely, mitigating the impression by utilizing time as a 3rd dimension: for those who don’t get in throughout spherical �, you’ll be able to simply wait till spherical �+1 which might be in per week and the place the worth in all probability won’t be that totally different.

We will have a sale which is uncapped as a complete, however which consists of a variable variety of intervals, the place the sale inside every interval is capped; this manner groups wouldn’t be asking for very giant quantities of cash with out proving their skill to deal with smaller rounds first. We will promote small parts of the token provide at a time, eradicating the political uncertainty that this entails by placing the remaining provide right into a contract that continues to promote it mechanically in accordance with a prespecified formulation.

Listed here are just a few attainable mechanisms that comply with a few of the spirit of the above concepts:

- Host a Gnosis-style reverse dutch public sale with a low cap (say, $1 million). If the public sale sells lower than 100% of the token provide, mechanically put the remaining funds into one other public sale two months later with a 30% increased cap. Repeat till your entire token provide is offered.

- Promote a limiteless variety of tokens at a worth of $� and put 90% of the proceeds into a wise contract that ensures a worth flooring of $0.9⋅�. Have the worth ceiling go up hyperbolically towards infinity, and the worth flooring go down linearly towards zero, over a five-year interval.

- Do the very same factor AngelShares did, although stretch it out over 5 years as an alternative of some months.

- Host a Gnosis-style reverse dutch public sale. If the public sale sells lower than 100% of the token provide, put the remaining funds into an automatic market maker that makes an attempt to make sure the token’s worth stability (observe that if the worth continues going up anyway, then the market maker could be promoting tokens, and a few of these earnings may very well be given to the event group).

- Instantly put all tokens right into a market maker with parameters+variables � (minimal worth), � (fraction of all tokens already offered), � (time since sale began), � (meant period of sale, say 5 years), that sells tokens at a worth of �(��−�) (this one is bizarre and should have to be economically studied extra).

Notice that there are different mechanisms that must be tried to unravel different issues with token gross sales; for instance, revenues going right into a multisig of curators, which solely hand out funds if milestones are being met, is one very attention-grabbing concept that must be accomplished extra. Nonetheless, the design house is very multidimensional, and there are much more issues that may very well be tried.

Supply: https://vitalik.eth.limo/basic/2017/06/09/gross sales.html

- search engine marketing Powered Content material & PR Distribution. Get Amplified At this time.

- PlatoData.Community Vertical Generative Ai. Empower Your self. Entry Right here.

- PlatoAiStream. Web3 Intelligence. Data Amplified. Entry Right here.

- PlatoESG. Carbon, CleanTech, Power, Atmosphere, Photo voltaic, Waste Administration. Entry Right here.

- PlatoHealth. Biotech and Scientific Trials Intelligence. Entry Right here.

- BlockOffsets. Modernizing Environmental Offset Possession. Entry Right here.

- Supply: Plato Information Intelligence.